how to calculate taxes taken out of paycheck in illinois

It is not a substitute for the advice of an accountant or other tax professional. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

What Is Taxable Income And How To Calculate It Forbes Advisor

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

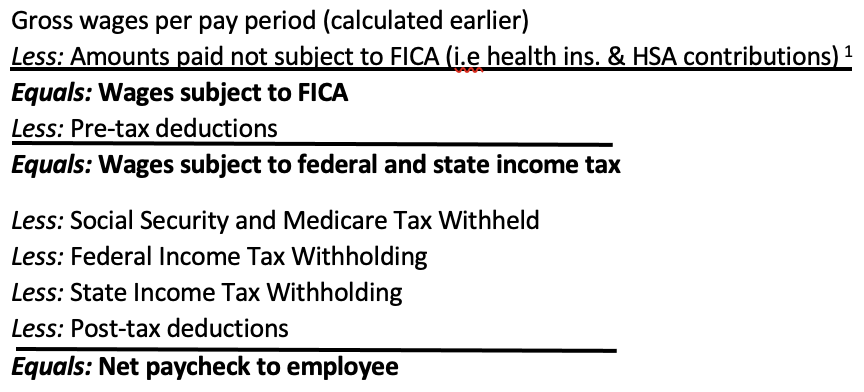

. It can also be used to help fill steps 3 and 4 of a W-4 form. 1216 on portion of taxable income. Adjusted gross income Post-tax deductions Exemptions Taxable income.

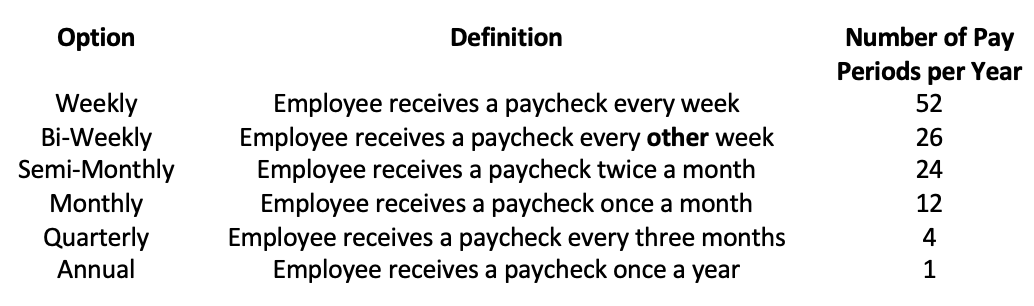

Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

1116 on portion of taxable income over 89482 up-to 150000. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. Employers are responsible for deducting a flat income tax rate of 495 for all employees.

View a Full Tax illustration and step by step tax calculation. Simply enter your Weekly earning and click calculate to see a full salary and tax illustration. 505 on the first 44470 of taxable income.

0495 for tax years ending on or after December 31 2020. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

How much tax is deducted from a paycheck Canada. Individual Income Tax return The income tax rate remains at 495 percent. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator.

If your itemized deductions are less than the standard deduction just claim the standard amount. The due date for filing your 2020 Form IL-1040 and paying any tax you owe is April 15 2021. This calculator is intended for use by US.

Illinois Salary Paycheck Calculator. 915 on portion of taxable income over 44470 up-to 89482. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Illinois Hourly Paycheck Calculator. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Illinois tax is calculated by identyfying your taxable income in illinois and then applying this against the personal income tax rates and thresholds identified in the illinois state tax tables see below for currect illinois state tax rates and historical illinois tax tables supported by the illinois state salary calculator.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. No cities within Illinois charge any additional municipal income taxes so its pretty simple to. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

How Your Paycheck Works. For post-tax deductions you can choose to either take the standard deduction amount or itemize your deductions. According to the Illinois Department of Revenue all incomes are created equal.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. Supports hourly salary income and multiple pay frequencies.

This free easy to use payroll calculator will calculate your take home pay. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Taxable Income in Illinois is calculated by subtracting your tax deductions from your gross income.

Personal income tax in Illinois is a flat 495 for 20221. Use the advanced salary calculations to tweak your specific personal exemption and standard deductions. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

No Illinois cities charge a local income tax on top of the state income tax though. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. Figure out your filing status.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inIllinois the net effect for those individuals is a higher state income tax bill in Illinois and a higher Federal tax bill.

118000 118 000 00 Tax Calculator 2022 23 2022 Tax Refund Calculator

Why Do I Owe State Taxes Smartasset

Calculate An Employee S Final Paycheck Free Calculator Onpay

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

What Does The Court Consider Income For My Divorce Proceedings

What You Need To Know About Hiring Workers Calculating A Paycheck Ilsoyadvisor

What You Need To Know About Hiring Workers Calculating A Paycheck Ilsoyadvisor

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Bonus Calculator Percentage Method Primepay

Filing Taxes On H1b Visa The Ultimate Guide

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022

Flat Bonus Pay Calculator Flat Tax Rates Onpay

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

New Hampshire Paycheck Calculator Smartasset

How Do You Calculate Back Pay The Crone Law Firm

Free Payroll Tax Calculator Paycheck Calculation Fingercheck

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)